INTERTANKO CII Clause for Short-Term Time Charterparties

27 June 2025

Introduction

Industry Carbon Intensity Indicator (CII) clauses for time charterparties often fall into one of two categories:

- “Best-Endeavours” clauses outlining the spirit of Charterers’ and Owners’ required co-operation, including the exchange of relevant data and information in an effort to maintain the vessel’s CII rating as the same on redelivery as it was on delivery; and

- Clauses following a more structured approach setting target CII ranges and rates upon delivery of the vessel that, if likely to be exceeded due to Charterers’ intended voyage orders within the charter period, allow Owners to either refuse the original voyage orders or request alternative orders to make up for the effect on the vessel’s CII rating.

Responding to Members’ requests for an alternative approach when it comes to existing CII clauses, and based on advice from Members of INTERTANKO’s Commercial & Markets Committee and Documentary Committee as well as industry feedback, a dedicated working group within the Documentary Committee was put together to draft an alternative clause that would follow an approach where, despite Charterers’ orders resulting in a negative effect on a vessel’s attained CII, those orders could still be performed against a premium on hire to Owners calculated with a pre-agreed formula.

Whilst maintaining full flexibility as to the vessel’s employment, which is of paramount importance to Charterers, the clause drafted by the working group also gives Owners the rights to raise objections should the Charterers' voyage orders be expected to impact negatively on the vessel’s attained CII, and to propose or request alternative voyage orders aimed at maintaining the vessel’s rating within the agreed range or even improving it.

The clause is intended for short-term time charterparty employment with an indicative charter duration of up to six months. The clause provides for calculation of any premium due after the completion of each relevant voyage within the duration of the time charter.

There is an optional provision for a discount should Owners’ proposed alternative voyage orders be followed that then lead to an improvement over the vessel’s agreed target reference CII.

INTERTANKO Draft CII operations Clause for Short-Term Time Charterparties

1.1 The vessel's carbon intensity indicator (“CII”) rating, calculated in accordance with the regulations on carbon intensity contained in chapters 1, 2 and 4 of Revised MARPOL Annex VI and Resolution MEPC. 328 (76), or any resolution supplementing or replacing the same, is [insert letter rating] as at the date of this charterparty. Thereafter, upon delivery, the Owner shall provide to the Charterer the actual CII year to date (“YTD”). The Charterer acknowledges that the CII rating is affected by the Charterer’s manner of employment of the vessel.

1.2 If an order for employment (being deemed to include any speed instructions) is given by the Charterer which the Owner considers will produce an attained CII (“CIIA”) for the voyage materially exceeding the agreed target reference CII (“CIIR”) for the vessel, the Owner may propose amendments to the order aimed to reduce the expected CIIA for the voyage. Both CIIA and CIIR are further defined in sub-clause 3 below.

1.3 If the Charterer declines to amend its employment order in accordance with the Owner's proposal, the voyage shall be performed in accordance with the Charterer's unamended order, if legitimate, but the rate of hire for such voyage shall be adjusted in accordance with the following formula:

where:

A is the lumpsum premium on hire;

CIIA is the attained CII for the voyage, which shall be assessed on a leg-to-leg basis full away on passage (“FAOP”) to FAOP* or as otherwise agreed between the parties, excluding any periods of off-hire;

CIIR is the agreed target reference CII, which in default of agreement will be mid-point C;

E is either the daily hire rate or other rate as agreed between the parties for the purpose of this clause; and

T is the number of days during the voyage where the attained CII (noon to noon) > CIIR.

1.4 [OPTIONAL] If the Owner proposes a voyage where CIIA is below CIIR and the Charterer amends its order in accordance with the Owner’s proposal, the rate of hire shall be adjusted in accordance with the following formula:

where:

A is the lumpsum discount on hire;

CIIA is the attained CII for the voyage, which shall be assessed on a leg-to-leg basis from full away on passage (“FAOP”) to FAOP* or as otherwise agreed between the parties, excluding any periods of off-hire;

CIIR is the agreed target reference CII, which in default of agreement will be mid-point C;

E is either the daily hire rate or other rate as agreed between the parties for the purpose of this clause; and

T is the number of days during the voyage where the attained CII (noon to noon) < CIIR.

* or in the event of re-delivery from FAOP to redelivery or at the end of calendar year if that occurs within the charter period

1.5 If the Charterer disputes the Owner's calculation of adjustment to hire under sub clause 3 [or 4], either party may require a determination by [ ] as an independent expert, to be deemed jointly appointed, to verify the Owner's CII calculations, following which any adjustments under sub-clause 3 [or 4] shall be made pursuant to the expert's determination, to be final and binding upon the parties for the purpose of any adjustments hereunder.

1.6 Any premium [or discount] under sub-clause 3 [or 4] shall be added to [or deducted from] the final hire payment that falls due after the last voyage has been performed and after the Owner has submitted to the Charterer its calculation of an adjustment or following the expert’s determination, as the case may be, under sub-clause 5. [The total accrued discounts may not in any case exceed the total accrued premiums under this clause, and in the event of an excess in total accrued discounts above total accrued premiums, the adjustment under this clause shall be nil].

Explanatory Notes

The formula in the clause refrains from using or referring to “annualised” CII ratings, values or other figures because it requires the parties to reconcile on a per-voyage basis. This is especially practical where delivery and redelivery occur in different calendar years, and the use of the annualised CII rating could otherwise complicate the calculations and the use of the formula.

Instead, the approach of the clause is for the parties to agree, prior to concluding the charter, on the CIIR (i.e. the target reference CII), with suggestions of what CIIR could be listed below:

- CII YTD upon delivery of the vessel to Charterers;

- CII value corresponding to midpoint C for subject vessel for the calendar year in question; or

- CII value corresponding to turn point from C to D for subject vessel for the calendar year in question.

If the parties do not agree on a specific CII value as CIIR, then the default position to apply is for the value of mid-point C to be used as CIIR.

The CIIR will have a direct effect on any premium on hire as it sets the base above which a premium, as remuneration, would become payable to Owners. Midpoint C may be the preferred choice, rather than turn point C to D, as it allows a safety margin for compliance with unforeseen issues that may reduce the CIIA (i.e. the attained CII).

In addition to agreeing on the CIIR and for the purpose of the clause, the parties should also agree a daily rate (which could be the hire rate or a percentage of it, such as 25%, 50% or 75%) to represent adequate remuneration to Owners for allowing Charterers full operational flexibility in its voyage orders.

Worked example:

To illustrate how the clause would operate, we have used an example of an Aframax tanker of 90,000 DWT fixed on a time charter commencing on 1 February 2025 for a duration of three months, with a hire rate of USD 20,000 pd.

The remuneration agreed is 25% of the hire rate, i.e. USD 5,000 pd.

|

CII ranges |

CII value (for 2025) |

|

Rate A |

…< 3.72 |

|

Rate B |

3.72<…<4.22 |

|

Rate C |

4.22<…<4.90 (Midpoint C= 4.54) |

|

Rate D |

4.90<…<5.81 |

|

Rate E |

… > 5.81 |

The vessel was delivered to Charterers on 1 February 2025 with a CII rating of 4.45 (C) and the same was maintained upon commencement of the first voyage under the charter.

Upon instruction from Charterers, the vessel performed an initial voyage lasting 30 days that lead to a CIIA of 5.2 (D).

Within the duration of this initial voyage and further to the reconciliation between Owners and Charterers, it was shown that for 25 out of the 30 days, the CIIA exceeded the CIIR.

Scenario No. 1: CIIR is Midpoint C

Midpoint C is 4.54, as such CIIR = 4.54.

Using the formula in the clause, the lumpsum premium payable through the reconciliation and calculation process after the completion of the voyage is as follows:

A = (CIIA – CIIR)/CIIR × E × T = (5.2 – 4.54)/4.54 x 5,000 x 25 days = USD 18,171.25 payable as a lumpsum premium to Owners.

Scenario No. 2: CIIR is CII YTD rating on commencement of voyage

CII YTD on commencement of this first voyage was 4.45 (C), as such CIIR = 4.45.

A = (CIIA – CIIR)/CIIR × E × T = (5.2 – 4.45)/4.45 x 5,000 x 25 days = USD 21,000.00 payable as a lumpsum premium to Owners.

Scenario No. 3: CIIR is turn point between C to D (i.e. CIIR = 4.90)

A = (CIIA – CIIR)/CIIR × E × T = (5.2 – 4.90)/4.90 x 5,000 x 25 days = USD 7,650.00 payable as a lumpsum premium to the Owner.

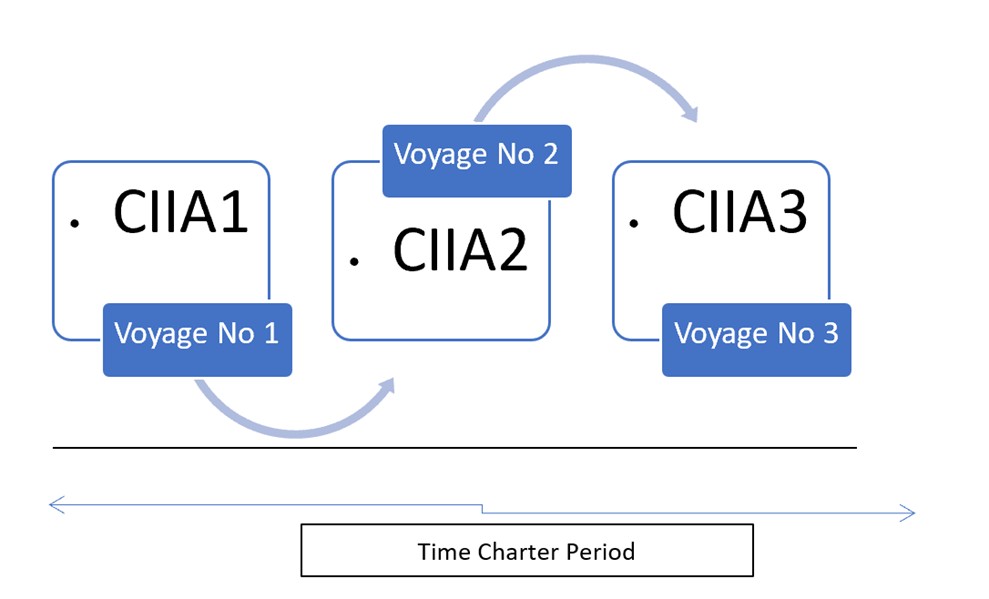

The above sample calculations are to be repeated between Owners and Charterers for all voyages during the charter period as follows:

By reconciling any payable premiums on a voyage-by-voyage basis and with the aggregate CIIA (in our example comprising of CIIA1 from Voyage No. 1, CIIA2 from Voyage No. 2, etc.) remaining within the boundaries of C, the final reconciliation upon redelivery should avoid the requirement for any substantial CII-related remuneration.

For more examples, see the Additional Examples/Calculations in the Troubleshooting Guide below.

Members can also access further Additional Examples/ Calculations here.

Troubleshooting Guide

Will the Optional Bolt-on Provision (sub-clause 4) of the Draft Clause be welcomed by Owners?

We expect that the immediate reaction from Members to the discount proposal may be negative, as CII clauses have so far only been discussed within the context of Owners’ remuneration in exchange for affording Charterers’ full operational flexibility. However, in order to incentivise Charterers to agree to such a remuneration provision, the working group believed that adding in the discount provision at sub-clause 4 in favour of Charterers would be effective.

To cater for any immediate negative reactions from Owners, which could potentially lead to a complete rejection or non-consideration of the clause, the discount provision at sub-clause 4 is as such labelled “Optional”.

Why should (time) Charterers pay a premium if the vessel’s CII rating throughout the duration of the Charter remains within the “compliance” window (i.e. within C)?

Conceptually, if a vessel’s rating lies within C, as far as the CII regulations are concerned, the vessel is in compliance and there is no immediate pressure on Owners to take corrective actions or start safeguarding, provided Charterers exercise cautious employment of the vessel.

Within the context of the clause, setting of the CIIR (i.e. the target reference CII) is of paramount importance as it acts as the “initiator” for the consideration of any premium due to Owners, as remuneration.

The clause isn’t intended to act as an indication of what is an industry-acceptable CII window within which both Owners and Charterers can operate with no limitations. This is why the clause leaves the parties to agree on the CIIR (i.e. the target reference CII).

It is important to note, however, that the clause provides for Owners to be compensated only in those cases where Charterers insist on performance of their original voyage orders despite their negative effect on the vessel’s CII rating and after (and despite) Owners having raised this issue with Charterers and either proposed, or requested, alternative voyage orders, being declined by Charterers.

Additional Examples/Calculations

1 Aframax Tanker – 75,000 DWT

Hire rate agreed is USD 20,000 pd.

Daily remuneration agreed is 25% of the hire rate, i.e. USD 5,000 pd.

|

CII Ranges |

CII Value (for 2025) |

|

Rate A |

…< 4.16 |

|

Rate B |

4.16<…<4.72 |

|

Rate C |

4.72<…<5.48 (Midpoint C: 5.07) |

|

Rate D |

5.48<…<6.49 |

|

Rate E |

… > 6.49 |

The vessel was delivered to Charterers on 1 February 2025 with a CII rating of 4.90 (C), and the same was maintained upon commencement of the first voyage under the charter.

Upon instruction from Charterers, the vessel performed an initial voyage lasting 30 days that lead to a CIIA of 5.4 (C).

During the voyage, and further to the reconciliation between Owners and Charterers, it was shown that for 25 out of the 30 days, CIIA exceeded the CIIR.

Scenario No. 1: CIIR is Midpoint C

Midpoint C is 5.07 as such CIIR = 5.07.

Using the formula in the clause, the lumpsum premium payable through the reconciliation and calculation process after the completion of the voyage is as follows:

A = (CIIA – CIIR)/CIIR × E × T = (5.4 – 5.07)/5.07 x 5,000 x 25 days = USD 8,125.00 payable as a lumpsum premium to Owners.

Scenario No. 2: CIIR is CII YTD rating on commencement of voyage

CII YTD rating on commencement of the first voyage was 4.9 (C) and as such CIIR = 4.9.

A = (CIIA – CIIR)/CIIR × E × T = (5.4 – 4.9)/4.9 x 5,000 x 25 days = USD 12,755.00 payable as a lumpsum premium to Owners.

Scenario No. 3: CIIR is turn point between C to D (i.e. CIIR = 5.48)

Since the CIIA did not exceed the CIIR, no remuneration is payable.

2 Mixed Example (three-month time charter) based Example 1 (90,000 DWT) using Scenario No. 3

Aframax tanker of 90,000 DWT fixed on a time charter commencing on 1 February 2025 for a duration of three months, with a hire rate of USD 20,000 pd.

The remuneration agreed is 25% of the hire rate, i.e. USD 5,000 pd.

|

CII ranges |

CII value (for 2025) |

|

Rate A |

…< 3.72 |

|

Rate B |

3.72<…<4.22 |

|

Rate C |

4.22<…<4.90 (Midpoint C= 4.54) |

|

Rate D |

4.54<…<5.81 |

|

Rate E |

… > 5.81 |

The vessel was delivered to the Charterer on 1 February 2025 with a CII rating of 4.45 (C) and the same was maintained upon commencement of the first voyage under the charter.

We apply Scenario no. 3 where CIIR is the turn point between Rate C and D i.e. CIIR= 4.54

1st Month:

CIIA = 5.5

20 days within which CIIA > CIIR: Premium Calculable

2nd Month:

CIIA = 5.8

25 days within which CIIA >CIIR: Premium Calculable

3rd Month:

CIIA = 4.3

15 days within which CIIA < CIIR: Discount Calculable

Calculation of Premiums/Discounts under each month

1st Month:

A = [(CIIA – CIIR) / CIIR] x E x T = [(5.5-4.54)/4.54] x 5000 x 20 = USD 21,100.00

2nd Month:

A = [(CIIA-CIIR)/CIIR] x E x T = [(5.8 – 4.54)/4.54] x 5000 x 20 = USD 27,700.00

3rd Month:

A= [(CIIA – CIIR) / CIIR] x E x T = [(4.30 – 4.54)/ 4.54] x 5000 x 15 = -USD 3,914.50

Upon Redelivery, Premiums and “Discounts” are offset and as such:

1st Month + 2nd Month + 3rd Month = USD 21,100.00 + USD 27,700.00 + (-USD 3,914.50) = USD 44,885.50 payable to Owners.